Does a Lemon Title Affect Insurance?

A lemon title can affect insurance because it signals to insurers that the vehicle may have had serious problems, even if some issues have been fixed. Some insurance companies may still refuse coverage, while others could charge higher premiums due to the vehicle’s history. Therefore, yes, a lemon title can directly impact both your ability to insure the car and the cost of that insurance.

The Lemon Pros are experts in dealing with the Lemon law and defective vehicles. Because their practice area is focused on lemon vehicles, they’ve been able to secure millions of dollars in compensation for drivers. Contact us today to get a free consultation about your branded title vehicle!

In this comprehensive guide, we define the meaning of branded title cars and show you what the label means for insurance companies. We also provide you with some tips to help you save money and protect yourself from a lemon title.

Table Of Contents

- What Is a Lemon Title?

- Does a Lemon Title Affect Insurance Premiums and Coverage?

- How Lemon Titles Influence Vehicle Resale and Insurance Claims

- How Lemon Law Buybacks Impact Warranties and Insurance?

- Tips for Insuring a Lemon-Titled Vehicle

- Alternatives to Lemon-Titled Vehicles

- Steps to Take If Your Vehicle Has a Lemon Title

- Need Help From an Experienced Lemon Law Attorney?

- Frequently Asked Questions

What Is a Lemon Title?

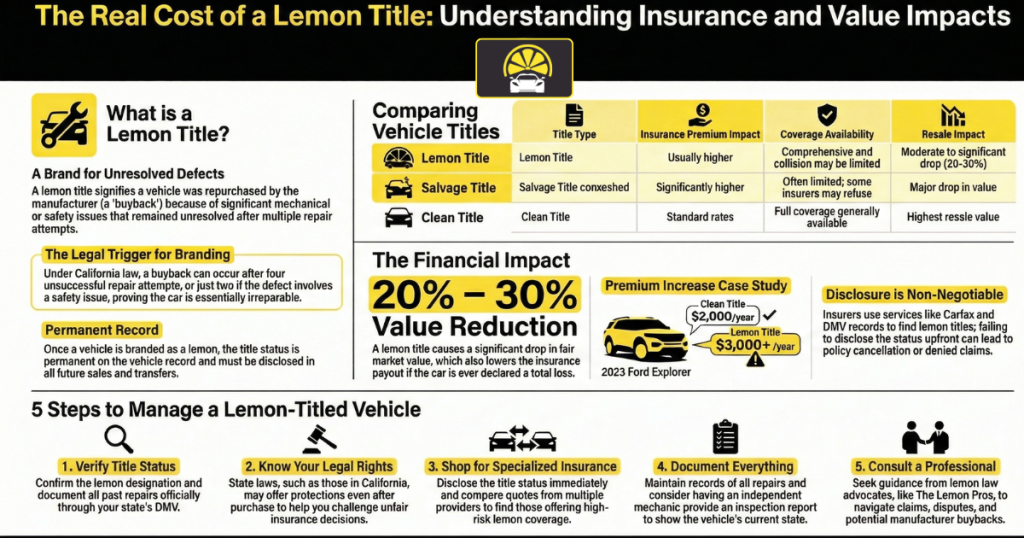

A lemon title is a branded title vehicle that indicates the car was repurchased by the manufacturer due to significant defects. Typically, these defects manifest as unresolved manufacturing or mechanical issues, sometimes related to a car recall, even after numerous attempts at repair. Unlike a standard salvage or rebuilt title, a lemon title specifically reflects problems that make the vehicle unreliable or unsafe.

A vehicle receives a lemon title through a buyback under state lemon laws, such as the California lemon law. In California, for example, new cars must show defects within 18,000 miles or 18 months of ownership. Used cars are covered only during the dealership warranty period. A buyback can occur after four unsuccessful repair attempts, or two if the issue affects safety, proving the car is essentially irreparable.

Once the manufacturer repurchases the vehicle, the title is changed to reflect its lemon status. This branding causes a significant drop in its fair market value. A lemon title must also be disclosed in any future sales or transfers, ensuring buyers are aware of the car’s history.

Lemon titles are common in states with strong consumer protection laws, like California, but rules vary across the U.S. Some states, such as Arkansas and Virginia, have less strict regulations. Because laws differ, consulting a qualified lemon law attorney is important for understanding your rights and options.

Does a Lemon Title Affect Insurance Premiums and Coverage?

A lemon title or salvage title directly affects how insurance companies view your vehicle. Insurers see these cars as higher risk because past defects or car structural damage may affect safety and reliability. Before offering coverage, they perform a detailed risk assessment to determine eligibility for different types of policies.

Premiums for lemon or salvage-titled vehicles are usually higher. Comprehensive and collision coverage can be pricier or limited due to the risk of structural damage, while liability coverage may remain mostly unaffected. Some insurers may even decline certain coverages if they believe the vehicle poses too much risk.

Always disclose your lemon or salvage title when applying for insurance. Failure to do so can lead to denied claims or policy cancellations. Being upfront protects you legally and helps ensure you receive the most appropriate coverage for your vehicle’s history. To better understand how different vehicle titles affect insurance and resale, the table below highlights the key differences between lemon, salvage, and clean titles.

|

Title Type |

Insurance Premium Impact |

Coverage Availability |

Resale Impact |

Claim Handling |

|---|---|---|---|---|

|

Lemon Title |

Usually higher |

Comprehensive and collision may be limited |

Moderate to significant drop |

Insurers may require inspections; claims can be scrutinized |

|

Salvage Title |

Significantly higher |

Often limited; some insurers may refuse |

Major drop in value |

Claims often denied for structural damage; payouts may be lower |

|

Clean Title |

Standard rates |

Full coverage generally available |

Highest resale value |

Standard claim handling |

Insurance Premium Impact Explained?

Insurance premium impact refers to how a vehicle’s history and risk factors affect the cost of your insurance. Cars with lemon or salvage titles often face higher premiums because insurers see them as more likely to have problems or accidents. Factors like car structural damage, past repairs, and safety issues increase perceived risk. Higher risk means insurers may charge more or limit coverage. Even small issues on a vehicle history report can influence premium calculations.

Coverage Limitations and Exclusions for Lemon Vehicles

Coverage limitations and exclusions for lemon vehicles are common because insurers see them as higher risk. Comprehensive and collision coverage may be restricted or come with higher deductibles. Some insurers may exclude certain repairs related to past defects or car structural damage. The vehicle's history usually has less of an impact on liability coverage, but it can still influence it. Understanding these limitations helps owners avoid surprises when filing a claim.

Disclosure Obligations to Insurance Companies

Disclosure obligations to insurance companies require you to provide accurate information about your vehicle’s history. This includes lemon titles, salvage titles, and any past car structural damage. Failing to disclose these details can lead to denied claims or policy cancellations. Being transparent helps insurers assess risk correctly and ensures you receive proper coverage. Always report title branding and significant repairs when applying for or renewing a policy.

How Lemon Titles Influence Vehicle Resale and Insurance Claims

Lemon titles can significantly reduce a vehicle’s resale value, often by 20–30%, because buyers know the car may have ongoing issues. Lower resale value also affects insurance total loss calculations, meaning insurers may offer less if the car is totaled. Vehicle history reports like Carfax clearly note lemon titles, which buyers and insurers rely on for transparency. This is especially important for anyone considering buying a lemon, as the financial and insurance implications are immediate.

According to Michael Saeedian, Esq, "A lemon title doesn’t just affect resale; it can change how insurers view your car entirely. Full disclosure is key to avoiding surprises."' Insurance companies handle claims on lemon-titled vehicles carefully. Some may limit coverage or require additional inspections. Full claim payouts or replacement vehicles can be harder to obtain if the insurer considers the car a higher risk. Clear disclosure of the lemon title is essential to avoid disputes.

Consumers can protect themselves by keeping records of repairs and fixed issues. Always disclose the lemon title when selling or transferring the car. Understanding the impact on resale value helps buyers and insurers set fair prices. Checking vehicle history reports ensures transparency and can prevent surprises during insurance claims.

Impact of a Lemon Title on Insurance Premiums

Lemon-titled vehicles come with an inherent risk that alarms insurance companies. The provider may limit the amount of coverage offered and can charge a higher premium. Moreover, the insurance company might reject claims associated with the lemon issue.

For example, an owner of a 2023 Ford Explorer may pay approximately $2,000 per year for insurance coverage. However, the same car with a lemon title could cost $3,000 or more per year, depending on the driver’s record and the coverage required.

There’s also a significant impact on the car's resale value. If the vehicle’s history indicates trouble with defects, the fair market resale value accordingly drops. Future buyers will likely notice this drop, making it more difficult to sell the car for a reasonable amount of money.

How Lemon Law Buybacks Impact Warranties and Insurance?

The Lemon Law buyback occurs when the manufacturer reimburses the driver for the purchase or lease of the car in exchange for it. When this happens, the title is branded to alert future drivers that the vehicle is a lemon. This situation affects not only the insurance but also the warranty.

From an insurance standpoint, the car becomes a high-risk vehicle, and the owner may have to pay higher premiums. The policy may also have restrictions regarding the types of claims that can be made. Some insurance providers may refuse to offer specific policies, such as comprehensive or collision coverage.

With the warranty, the Lemon Law buyback may result in losing some coverage. If there’s no more extended warranty protection, the driver faces higher expenses for any significant repairs that are needed. It could also become difficult to purchase an extended warranty with a lemon title due to any possible hidden issues.

Tips for Insuring a Lemon-Titled Vehicle

If you plan to buy a used car with a lemon title, there are some tips to help you get insurance coverage that protects your investment. Here are a few to consider.

Do Your Research: Look for a reputable insurer that offers high-risk lemon coverage.

Shop Around for the Best Rates: While your options may be smaller, you can still shop around to find the best rate. Ask for discounts if you have a good driving record and credit score.

Document Repairs: If you are working to obtain a rebuilt title, where the car has been repaired, be prepared to show the insurance company all the repairs that were made. We recommend having an independent mechanic inspect the vehicle and provide a report.

The Lemon Pros have experience working with defective cars, manufacturers, and insurance companies. If you need support during this time, please call for a free consultation.

Alternatives to Lemon-Titled Vehicles

On a national level, the NMVTIS title database, supported by the U.S. government, covers more than 99% of U.S. vehicle registrations and tracks branded histories across states. Owning a lemon-titled car may not be the best choice for everyone. If you’ve explored the financial implications, the limited insurance options, and the resale challenges, you might choose to avoid driving a lemon vehicle.

Sell or Trade-In

Instead of dealing with the limited coverage and the continuous repair bills, you may prefer to sell or trade in the vehicle. Selling the car can help you recover some value and buy a new, defect-free one. It may be easier to trade in the vehicle with a dealership that can handle the implications of the lemon title. Private sellers are still responsible for disclosing the information, and this may be something you aren’t equipped to handle.

Extended Warranties

If you prefer to keep the car, consider an extended warranty for added protection against mechanical issues. While the extended warranty can give you peace of mind and reduce your financial risk, you will need to budget for some upfront costs. Additionally, the plan may not cover all of the issues, and even full coverage may exclude problems related to the lemon case.

Before purchasing a limited warranty, review the relevant federal guidelines to ensure you are fully informed. It’s also beneficial to compare plans and providers to determine which one best suits your needs. If you don’t need coverage for things such as a rental car or roadside assistance, there’s no reason to pay more for these plans. You also want to ensure the plan covers the specific components you are concerned about. Some only cover the powertrain (engine and transmission), while others offer a full bumper-to-bumper warranty.

Steps to Take If Your Vehicle Has a Lemon Title

If your vehicle has a lemon title, it is crucial to act carefully to protect your finances and legal rights. Following a clear process can help you manage resale, insurance, and potential repairs with confidence. At The Lemon Pros, we recommend the following steps to handle a lemon-titled vehicle effectively:

Step 1. Check Your Vehicle’s Title Status Officially

Verify the title status through your state’s Department of Motor Vehicles (DMV). Ensure the lemon designation is accurate and that all past repairs are documented.

Step 2. Understand Your Legal Rights

California lemon laws may protect you as an owner, even after purchase. Knowing your rights can help you challenge unfair insurance decisions or recover damages.

Step 3. Shop Smart for Insurance

When getting coverage, disclose the lemon title upfront. Some insurers may adjust premiums or offer limited coverage, so comparing quotes is essential.

Step 4. Seek Professional or Legal Advice When Needed

If disputes arise with insurers or buyers, consult professionals experienced in lemon law. At The Lemon Pros, we guide clients through claims, disputes, and potential buybacks.

Step 5. Contact Lemon Law Advocates

For expert support, reach out to The Lemon Pros. Our team can help you navigate claims, maximize your protections, and ensure proper disclosure to buyers and insurers.

Need Help From an Experienced Lemon Law Attorney?

It’s wise to learn more about the possible risks and ramifications, whether you wonder what the lemon title classification means on the CARFAX history of a used car, or you own a lemon and are concerned with how the branding may significantly impact the resale value. In California, all lemon cars must be branded, making them more difficult to insure and sell.

For the best advice, you want a qualified lemon law attorney on your side, such as The Lemon Pros. Our team of Lemon Law attorneys in California focuses exclusively on California Lemon Law cases and has helped drivers pursue claims, total loss disputes, and manufacturer buybacks. Contact us today for a free case evaluation to discuss your options at no cost.

Frequently Asked Questions

Owning a vehicle with a lemon title can raise questions about insurance coverage and costs. This FAQ explains how a lemon title may impact your ability to insure your car, your premiums, and potential payout if your vehicle is totaled

Can I Insure a Car With a Lemon Title?

Yes, you can usually insure a car with a lemon title, but coverage may be limited depending on the insurer. Most companies offer liability insurance, though getting full comprehensive or collision coverage might be more difficult or costly.

Does a Lemon Title Lower My Insurance Payout if the Car Is Totaled?

Yes, a lemon title can lower your insurance payout if the car is totaled, because insurers often value it less than a similar car with a clean title. The payout usually reflects the car’s diminished market value due to its lemon history.

How Do Insurance Companies Find Out if My Car Has a Lemon Title?

Insurance companies can find out if your car has a lemon title by checking the vehicle history report through services like Carfax or AutoCheck. They also have access to state DMV records that disclose branded titles, including lemons.

Are Lemon Titles Permanent on My Vehicle Record?

Yes, a lemon title is permanent on your vehicle record and will always indicate the car was formally declared a lemon. Even if the car is repaired or resold, the title brand remains to inform future buyers and insurers.

What Should I Do if My Insurance Denies Coverage Because of a Lemon Title?

If your insurance denies coverage due to a lemon title, first ask for a written explanation and review your policy terms. You can then shop around with other insurers, as some may still offer liability or limited coverage, or consider state assistance programs if available.

Disclaimer: The information provided on this blog is for general informational purposes only and does not constitute legal advice. Reading this content does not create an attorney-client relationship. Laws and regulations vary by jurisdiction and may change over time, so you should consult a Lemon Law attorney for advice regarding your specific situation. Past examples, case studies, or hypothetical scenarios are illustrative only and do not guarantee similar results.